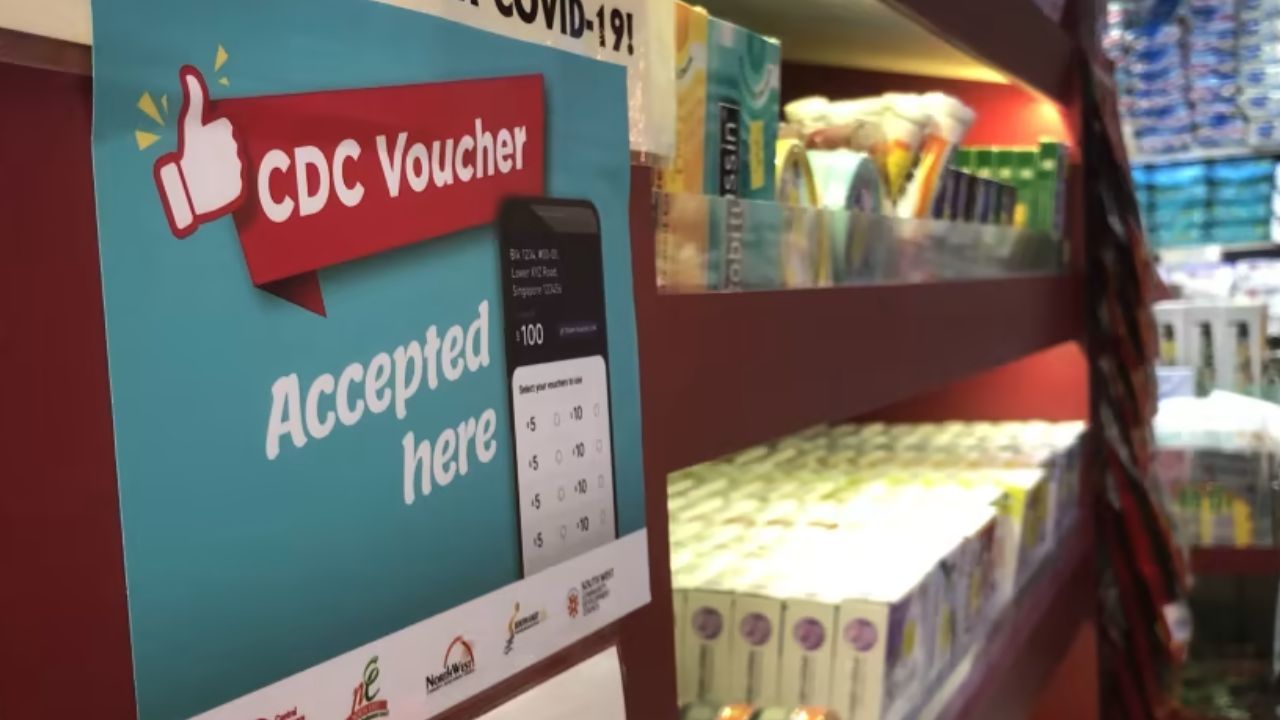

The Singapore government has rolled out significant financial support for its citizens through the CDC Vouchers and GST Vouchers. These initiatives are aimed at helping households tackle rising costs due to inflation and the ongoing pressure of living expenses. For many families, this financial aid brings much-needed relief and ensures that essential needs like food, healthcare, and utilities remain more affordable.

Table of Contents

Big CDC and GST Vouchers for 2025

The CDC Voucher Scheme is part of the Assurance Package announced by Deputy Prime Minister and Finance Minister Lawrence Wong during Budget 2024. It focuses on encouraging local spending while easing financial stress for families across the nation. Similarly, the GST Voucher Scheme for 2024-2025 offers targeted assistance to lower- and middle-income groups, helping them better manage their GST expenses and cope with the cost of living.

With GST continuing at 8% in 2025, many households in the lower- and middle-income bracket are feeling the pinch. These vouchers are designed to reduce that burden. Every household will receive $300 worth of CDC vouchers in 2025, distributed in two redemption phases. Together, these programmes highlight the government’s commitment to supporting citizens during challenging times.

Eligibility Criteria for CDC Vouchers

To qualify for the CDC vouchers, households must meet certain conditions. At least one member of the household must be a Singaporean citizen, although there are no restrictions related to income, assets, or property ownership. This inclusiveness means that seniors living alone, single-parent families, multi-generational households, and even young couples in new flats can all benefit. However, an active Singpass account is required to make an online claim.

Eligibility Criteria for GST Vouchers

The GST Voucher scheme is slightly more specific in its criteria. Individuals must be Singaporean citizens residing in the country and aged 21 or above in 2024. Their annual assessable income for the year of assessment 2023 must be below $34,000, and the annual value of their residence must not exceed $25,000. Additionally, individuals must not own more than one property. These conditions ensure that the financial aid reaches those most in need.

How to Claim the Vouchers

Claiming the vouchers has been made simple and convenient. For CDC vouchers, residents can claim them online by visiting the official CDC vouchers website and logging in with Singpass. After successful verification, a secure voucher link will be sent to their mobile number via SMS, which can then be used at participating stores until December 31, 2025. For those who prefer in-person claims or do not have access to a smartphone, visiting a nearby Community Centre with an NRIC will allow staff to print the vouchers for them.

For GST vouchers, no application is required if you have received GST payouts in previous years. However, new recipients or those who need to update their bank or property details must do so through the GSTV e-services portal before June 20, 2025, to ensure timely processing.

Payment Dates and Amounts

The CDC vouchers will be provided in two phases. The first tranche of $300 was distributed in June 2024, and the second tranche, worth $500, is scheduled for release in September 2025. Households can expect to receive notifications when their vouchers are ready to claim.

For GST vouchers, payouts are disbursed annually in August. MediSave and cash components will be credited according to the eligibility rules, while the GSTV U-Save and S&CC rebates will be distributed quarterly in April, September, and October 2025. The payout amounts vary based on the annual value of the home: households with a property AV of $21,000 or below will receive $850, while those with a property AV between $21,001 and $31,000 will receive $450.

A Step Toward Financial Stability

These voucher schemes represent a significant effort by the Singapore government to help families maintain financial stability. By easing the strain of GST expenses and providing additional funds for essentials, these initiatives are making a tangible difference in the lives of many.

The CDC and GST vouchers are more than just financial assistance they are a sign of the government’s commitment to supporting its people in times of rising costs. Citizens are encouraged to check their eligibility, claim their vouchers promptly, and make full use of them before the expiry dates. By planning their spending wisely, households can maximize the benefits and enjoy some relief from daily financial pressures.